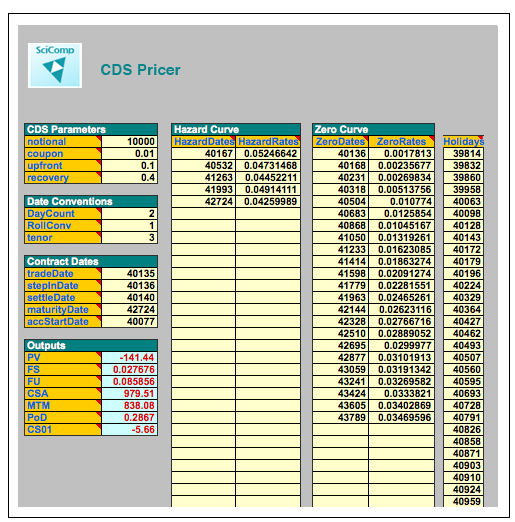

CDS Pricer

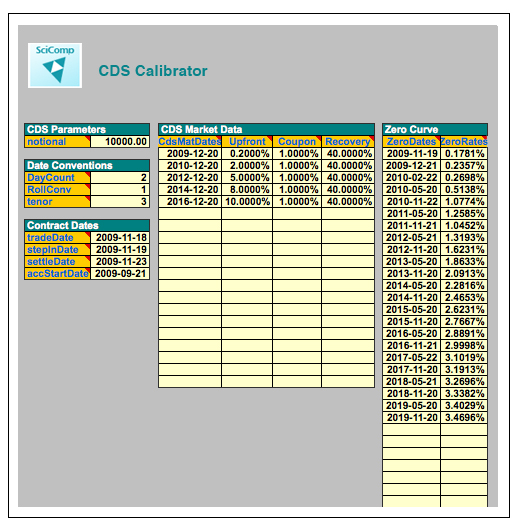

The CDS Pricer employs an intensity-based framework to price a standard credit default swap contract with upfront payment and subsequent running coupons. A CDS Calibrator is included to extract the underlying piecewise constant hazard curve from standard CDS market quotes.

The CDS Pricer provides comprehensive support for valuing credit default swaps with the standard range of features including:

- Running coupon rate, upfront point and recovery rate

- Both constant hazard rate or term structure hazard rates

- Calibration of hazard rates to CDS market quotes (spreads or upfront points with running coupons)

- Coupon date and maturity date adjustments, roll conventions, choice of day count basis and holiday calendar support

Like all SciComp Consulting solutions the CDS Pricer can be enhanced/modified to meet any particular modeling needs you may have and is available as C/C++ source code, Windows/Linux executable, or a ready-to-use Excel spreadsheet and add-in.

Credit Default Swap Pricer Output Data

- Fair upfront points for the given running coupon

- Cash-settlement-amount (for protection buyer)

- Mark-to-market value (for protection buyer)

- Probability of default until maturity

- Sensitivity of present value to a 1 basis point change in the coupon

rate (spread)

CDS Pricer

CDS Calibrator